A reduction in the interest rate and an increase in the loan ceiling are among new benefits announced by Prime Minister Andrew Holness for contributors to the National Housing Trust (NHT).

The benefits were outlined by Mr. Holness in his contribution to 2019/2020 Budget Debate in the House of Representatives on Tuesday.

The current loan limit of $5.5 million is to be increased to $6.5 million.

Mr. Holness said the initiatives, which will take effect in the next fiscal year are aimed at improving affordability and access to NHT's products.

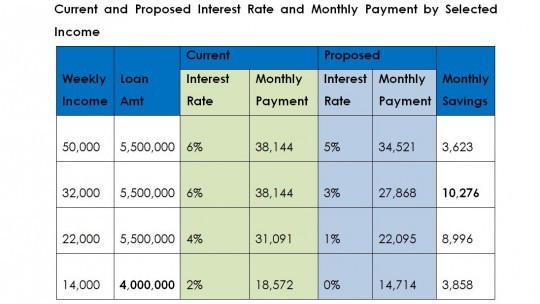

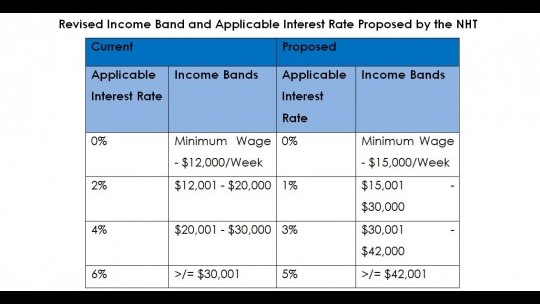

The NHT will reduce interest rates by one percentage point for all mortgagors in keeping with market trends of declining interest rates.

Additionally, the NHT will widen the current income bands to account for changes in earning levels since the last adjustment.

The ceiling for the lowest interest rate band will be increased to $15,000 per week from the current $12,000.

This will allow more persons to access the Home Grant.

The greatest reduction in mortgage payments will accrue to persons earning between $30,000 and $40,000 per week who will get a three per cent cut because of the combined impact of a shift in the upper limit of the income band as well as the one per cent mortgage rate decrease.

Mortgagors whose income range between $12,000 and $15,000 weekly will benefit from a two per cent reduction.

Intergenerational mortgages

The National Housing Trust will also provide intergenerational mortgages.

The aim is for a younger sibling or child to agree to carry the mortgage obligation, subject to affordability, when the older mortgagor retires or dies.

The loan will be scheduled over a 60-year period. The beneficiary's loan with the NHT will be scheduled to retirement and will include the portion of the costs to be covered during the period from the date of the loan to retirement.

For example, if the beneficiary has 20 years to retirement, only a third of the cost of the solution will be factored into the required payment.

Furthermore, the beneficiary will be required to present the NHT with an 'heir'.

That heir must be a younger sibling or child who will consent to repaying the outstanding amounts of the cost of the asset, which will be adjusted to current values.

That sibling will be allowed to take over the asset, if they agree to the various terms, including allowing the beneficiary to occupy the premises for an agreed time.

The Prime Minister said the initiative will cost the National Housing Trust $1.2 billion.

He said this will be partially offset by transferring to income, Contributors' Refunds that remain unclaimed for 10 years after they become due, increasing the loan limit and providing intergenerational mortgages.

comments powered by Disqus

All feeds

All feeds